Before you buy a life insurance plan, it is immensely important that you check whether the company from whom you are buying a policy is registered or not. Here for you help we are sharing IRDAI registered life insurance company list. These companies have valid license issued by the Insurance Regulatory and Development Authority of India (IRDAI) to carry out life insurance business in the country.

We have seen a significant growth in the insurance market around the globe. This sector has also evolved significantly in India. Rapidly growing insurance marketplace in India is luring many private and public sector companies.

Many renowned companies want to take advantage of this time and that’s why, the list of life insurance companies in India (public and private sector) is increasing day by day.

For your information, in India, all insurance companies run under the guidelines and rules of IRDAI (Insurance Regulatory and Development Authority of India). In terms to run insurance business in the country, a company will first need to obtain IRDI license.

Without obtaining a valid license, no company can carry out insurance business.

Therefore, it's mandatory first step for customers, to see whether their company has been listed in IRDA registered life insurance companies list or not.

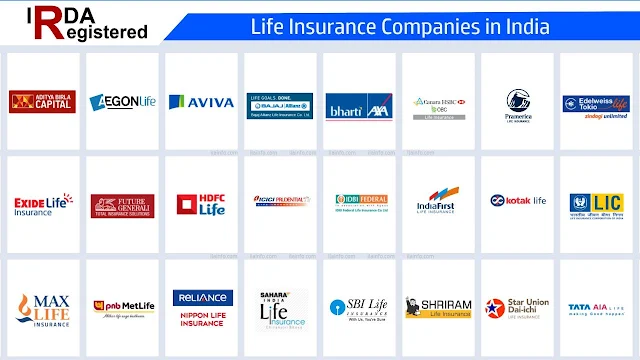

Next, I am showing you IRDAI registered list of Indian life insurance companies and the following companies have valid license issued by Insurance Regulatory and Development Authority to provide life insurance services in India.

Wait! Before I share IRDA life insurance company list with you, I want to share a very important thing which is:

If an insurance company has a valid license today then it might not have tomorrow. If IRDAI finds a company violating insurance selling guidelines then it can revoke license and ban that company.

Although, an a responsibility to provide you accurate information, we keep this life insurance companies list updated but still I advise you, always see updated list of insurance companies by visiting official website of IRDA.

Here you should also keep in mind that companies listed below are allowed to provide only life insurance related services. Some of these life insurers are not allowed to provide services related to general insurance which includes motor insurance, home insurance, health insurance and the like.

IRDAI Registered List of Life Insurance Companies in India

Here is a list of life insurers who have valid license to sell life insurance in India:

- Aditya Birla SunLife Insurance Co. Ltd.

- Aegon Life Insurance Company Limited

- Ageas Federal Life Insurance Company Limited

- Aviva Life Insurance Company India Ltd.

- Acko Life Insurance Limited

- Bajaj Allianz Life Insurance Co. Ltd.

- Bharti AXA Life Insurance Company Ltd.

- Canara HSBC Oriental Bank of Commerce Life Insurance Company Limited

- Credit Access Life Insurance Limited

- Pramerica Life Insurance Co. Ltd.

- Edelweiss Tokio Life Insurance Company Limited

- Exide Life Insurance Co. Ltd. (Exide Life Insurance Company has merged with HDFC Life Insurance Company on 14th October, 2022)

- Future Generali India Life Insurance Company Limited

- Go Digit Life Insurance Limited

- HDFC Life Insurance Company Limited

- ICICI Prudential Life Insurance Company Limited

- IndiaFirst Life Insurance Company Ltd.

- Kotak Mahindra Life Insurance Company Limited

- Life Insurance Corporation of India

- Max Life Insurance Company Limited

- PNB MetLife India Insurance Co. Ltd.

- Pramerica Life Insurance Company Limited

- Reliance Nippon Life Insurance Company Limited

- Sahara India Life Insurance Co. Ltd.

- SBI Life Insurance Company Limited

- Shriram Life Insurance Co. Ltd.

- Star Union Dai-Ichi Life Insurance Co. Ltd.

- TATA AIA Life Insurance Co. Ltd.

Note: IRDAI timely updates the registered Indian life insurance companies list because some life insurance companies quit their business and some new companies get registered. Therefore, you are requested to visit the official website of the institution to see the up-to-date list. Also, claim settlement ratios mentioned above are obtained directly from insurers websites.

Here as an insurance advisor, I endeavor to help you choose a right policy. Here are some things you should take into account while purchasing a policy:

- Don't just depend on your insurance agent's recommendations, you should also give your equal participation in it because in the end of the day it's you who will pay premiums and may face claim refusal (if chosen wrong policy). All you need to know is what are the different types of life insurance policies, what policy covers and how much cover should I take.

- Experts of this finance segment recommend insurance cover for up to 10-20 times of annual income.

- Read policy wordings clearly and understand everything before you pay your first premium.

- Try to know currency claim settlement ratio of the insurer to get hassle free claim settlements.

- Read customer reviews to know how good company's services are.

- Pay premiums only through cashless payment channels, don't pay in cash.

As like checking list of life insurance companies in India, It's also very important to consider some crucial factors such agent license, choosing a right policy which actually fulfills your insurance needs, before buying insurance policy.

If you're yet to pay your first premium then I strongly advise you read these posts, I promise you your time will not gone in vain. You will learn worth considering factors after reading these posts and will save decent money on premiums:

- 10 horrible mistakes to avoid while buying life insurance

- 9 questions you should ask your agent before you fill proposal form

- How to check if insurance company is legitimate

Frequently Asked Questions

How many life insurance companies are under IRDAI?

Insurance marketplace in India is evolving rapidly and many private sector companies starting their business. As of this writing, there are total 24 life insurance companies in India including Life Insurance Corporation of India (LIC) who have valid license issued by IRDA to conduct insurance business in the country.

Here is a list of life insurance companies in India with their claim settlement ratios and customer care numbers:

| Life Insurance Companies | Customer Care Number | Claim Settlement Ratio (%) |

|---|---|---|

| Aditya Birla SunLife Insurance Co. Ltd. | 18602669966 | 97.15 |

| Aegon Life Insurance Company Limited | 18001204433 | 96.45 |

| Aviva Life Insurance Company India Ltd. | 18001037766 | 96.06 |

| Ageas Federal Life Insurance Company Limited | 18002090502 - IDBI Federal Life Insurance renamed as Ageas Federal Life Insurance | 96.06 |

| Bajaj Allianz Life Insurance Co. Ltd. | 18002097272 | 99.18 |

| Bharti AXA Life Insurance Company Ltd. | 18001024444 | 97.28 |

| Canara HSBC Oriental Bank of Commerce Life Insurance Company Limited | 18001030003 | 94.04 |

| Credit Access Life Insurance Limited | +91-8069978070 | Not Obtained |

| Pramerica Life Insurance Co. Ltd. | 18001027070 | Not Obtained |

| Edelweiss Tokio Life Insurance Company Limited | 18002121212 | 95.82 |

| Exide Life Insurance Co. Ltd. | (Exide Life Insurance Company has merged with HDFC Life Insurance Company effective from the End of Day 14th October, 2022) | |

| Future Generali India Life Insurance Company Limited | 18001022355 | 95.15 |

| Go Digit Life Insurance Limited. | 996012612 | 95 |

| HDFC Life Insurance Company Limited | 18003157373 | 99.03 |

| ICICI Prudential Life Insurance Company Limited | 18602667766 | 98.6 |

| IndiaFirst Life Insurance Company Ltd. | 18002098700 | 94.23 |

| Kotak Mahindra Life Insurance Company Limited | 18002098800 | 97.40 |

| Life Insurance Corporation of India | 02268276827 | 97.79 |

| Max Life Insurance Company Limited | 18601205577 | 98.74 |

| PNB MetLife India Insurance Co. Ltd. | 18004256969 | 96.21 |

| Reliance Nippon Life Insurance Company Limited | 18001021010 | 97.71 |

| Sahara India Life Insurance Co. Ltd. | 18001809000 | Not obtained |

| SBI Life Insurance Company Limited | 18002679090 | 95.6 |

| Shriram Life Insurance Co. Ltd. | 18001022234 | |

| Star Union Dai-Ichi Life Insurance Co. Ltd. | 18002668833 | 96.7 |

| TATA AIA Life Insurance Co. Ltd. | 18602669966 | 99.07 |

Who regulates insurance companies in India?

The Insurance Regulatory and Development Authority of India (IRDA) is responsible for regulating, monitoring and expanding insurance industry in India. Along with protecting the interests of the policyholders, it ensures that insurance marketplace is expanding in the country as expected.

Any business who wants to provide insurance services in the country needs to obtain license from the authority first. Before you buy an insurance policy make sure to see list of registered insurance companies.

Comments

Post a Comment

Have a question? Just ask in comment box!